Blog

Top Tags

stationery

|

japanese stationery box

|

stationery pack

|

Japanese culture

|

Previous Stationery Packs

|

annoucement

|

giveaway

|

Previous Packs

|

ZenPop Giveaway

|

japanese stationery pack

|

Featured Article

Explore original Japanese stickers from Midori, Kamio, BGM, Ryuryu, and Mind Wave. Unique flake, washi, and nostalgic designs to elevate your stationery.

Discover the 8 best Japanese pencil cases — from cute to functional — and find the perfect case to carry your pens, pencils, and stationery.

Discover 5 cute Japanese stickers that go beyond anime—retro, nostalgic, and refined otona kawaii styles perfect for journals, planners, and collectors.

Explore how Japanese stationery uses minimalism and seasonal design to reflect nature's beauty. Learn how everyday items tell quiet stories through thoughtful details.

Discover ROKKAKU, a Kyoto stationery brand famed for foil-stamped cards, tapes, and notebooks. Celebrate everyday moments with Japanese elegance.

Learn how recent US tariff changes may affect your ZenPop shipments. Find details on pricing, customs, and what these updates mean for your orders.

Discover what makes BGM masking tape and stickers special. Compare BGM vs mt, World Craft, Mindwave, and more in this guide for Japanese stationery lovers.

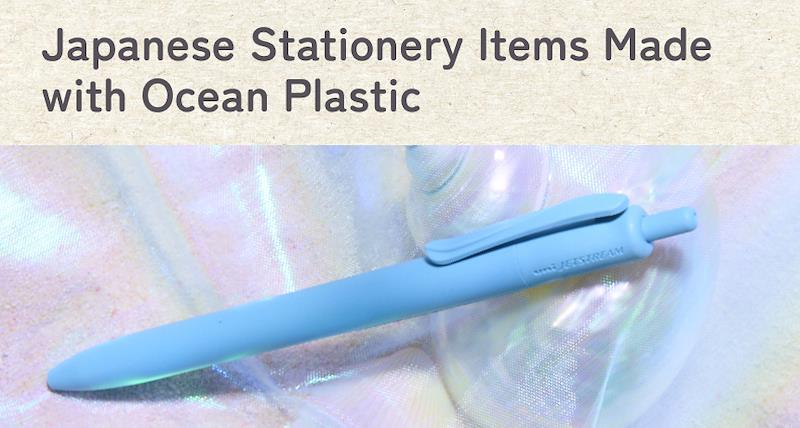

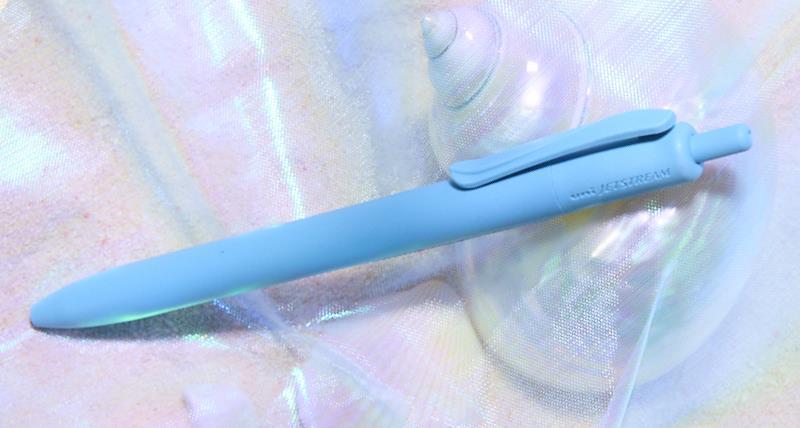

Explore eco friendly stationery from Japan made with ocean plastic, tea leaves, and recycled materials. Discover sustainable tools that are as smart as they are beautiful.

What are all those Japanese stickers and how can you best use them? Find out here.

Discover 10 Japanese products that are perfect for your new Scrapbooking project!

Explore the cultural roots and fine craftsmanship behind Japan’s love for mini stationery—small tools with big function, charm, and everyday joy.